Dear Client,

Bould Consulting write to offer our services to you or your clients to ensure the Value at Risk (VAR) amounts are both adequate and appropriate under current policies . Given the significant activity in the development and construction sector in the Cayman Islands over the past several years and in particular the significant current development taking place, a review of the VAR at this time would be prudent to avoid any unpleasant surprises in the unfortunate occurrence of a catastrophe. Coupled with this is the hardening of the insurance market and the significant increase in premiums being seen on policy renewal and hence the need for cover to be not only adequate but also appropriate.

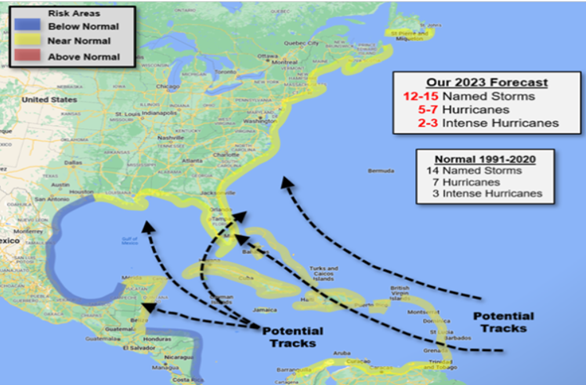

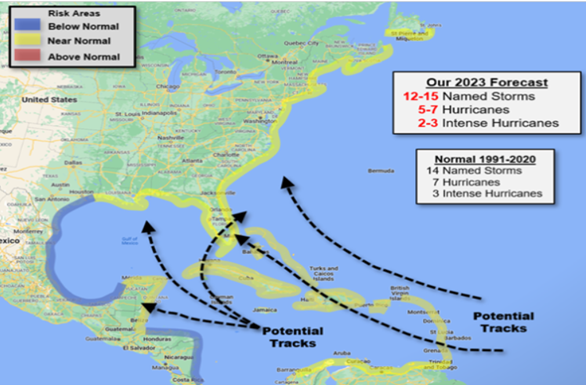

We are now getting close to the 2023 Hurricane Season, and the names to be used for any hurricanes are now published. Based on information currently available the forecast suggests 12 to 15 named storms and 5 to 7 hurricanes. See below:

Source:https://www.stormgeo.com/weather/articles/atlantic-hurricane-season-forecast/2022-full-forecast/

The 2022 season exceeded forecasts, with 14 named storms and 8 hurricanes ( 2 became intense) hence the currently published figures for 2023 must be treated with a degree of caution.

Hurricane Ian was forecast to pass directly over Grand Cayman in September, however we were lucky that the direction of travel changed at the last minute, meaning that the hit suffered in the Cayman Islands was less than forecast—the downside was that Florida suffered higher damage than expected—and many parts of Florida still remain affected by the after affects of Hurricane Ian

As the season approaches it is important to be aware that Insurance is essential, to include all that is needed at the right level.

A typical season runs from the start of June until the end of November, with the highest activity likely in August and September. Many insurance companies will not accept new applications during the season—even more will not accept new applications once a storm is named

If not yet done, it is strongly recommended that you ensure that you have adequate insurance to see you through the rest of the Hurricane Season.

For further details for Cayman Islands see link below:

https://caymanresident.com/live/disaster-preparedness/hurricane-preparedness/hurricane-season-overview#2022-hurricane-season

In March 2022, the Cayman Islands Government launched the National Emergency Notification system app, this can be downloaded via a link from the above.

We have recently experienced significant increases in materials and labour costs, for well known, reasons following the Covid 19 pandemic, and we therefore recommend that policies are reviewed more often than has typically been the case in the past. The RICS (Royal Institution of Chartered Surveyors) recommend reviews at maximum intervals of 3 years, however current costs of re-instatement now warrant more regular reviews of the type and level of cover required. It is recommended that cover is reviewed after no more than 2 years.

Many insurers apply clauses to policies that allow for any claim to be adjusted if it is determined that the level of insurance in place was inadequate when a peril occurs. This can be an easy trap to fall into when materials and labour costs have increased at rates seen over the last 2 years.

Bould Consulting have been preparing Reinstatement Cost Assessments (RCA) in the Cayman Islands and throughout the Caribbean for more than 50 years for a wide selection of building types for both private and public clients.

We look forward to being of service.

The Bould Consulting Team